Additional 5 increment on the balance of a if payment is not made after 60 days from the final date. This form shall become part of the Form C pursuant to section 77 A of the Income Tax Act 1967.

Sec Adopts New Online Submission Tool For Annual Reports

Last day of the 7 th month from the financial year-end.

. Income tax return for individual who only received employment income. All taxpayers Notification of change of address. Deadline Extended Deadline by e-Filing A.

Inland Revenue Board of Malaysia shall not be liable for. 18 Mar 2020 to 28 Apr 2020. Schedule On Submission Of Return Forms RF.

The 2022 filing programme stipulates the due date for the submission of the RF ie Form BT e-BT for resident individuals who are non-citizen workers holding key positions. Income tax return for partnership. 30062022 15072022 for e-filing 6.

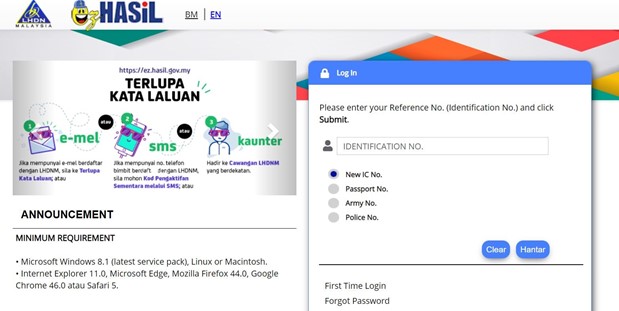

Legal News Analysis - Asia Pacific - Malaysia - Regulatory Compliance - Tax. Taxpayers may visit any nearest LHDNM branch for assistance in completing the Income Tax Return Form Or call the Hasil Care Line at the hotline 03-89111000 603-89111100 Overseas for further explanation. Companies Commission of Malaysia Submission of Statutory Documents.

YE 31 Oct 2019. The extension of the federal income tax filing due date and other tax. Last day of the 7 th month from the financial year-end.

52019 of 16 October which explains the penalties imposed on taxpayers that fail to file returns by the prescribed deadlines under the Income Tax Act 1967 the Petroleum Income Tax Act 1967 and the Real Property Gains Tax Act 1976The Guidelines includes that the. Within 3 months of change. Submission of income tax return - Resident - Non-resident.

Within 1 month after the due date. Form C1 for YA 2021. YE 30 Nov 2019.

Letter of authority verified copy of Form C RK-S from each surrendering company must be retained for examination by Lembaga Hasil Dalam Negeri Malaysia. --Please Select-- 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 dan sebelum Semua All. 30042022 15052022 for e-filing 5.

TP TJ TF 2020 and Forms CC1 PT TA TC TR TN 2021. Or may mail a claim form to terminix consumer fund co jeffrey c. Selangor Malaysia Taxpayers and employers which are companies are compulsorily required to submit Form C and Form E via e-Filing.

Within 1 month after the due date. Submission of tax estimate in Malaysia is mandatory under Section 107C of the Malaysian Income Tax Act 1967. Individuals without business income Notification of chargeability of an individual who first arrives in Malaysia.

The amount of penalty you will have to pay is as per below. Form C e-filing YE 31 Aug 2019. Fca Form C Deadline - Form C Submission Deadline Malaysia - qortiss - The fellow chartered accountant can use fca initials after his name.

Ree 3 months grace period from the due date of submission is allowed for those with accounting period ending 1 September 2019 until 31 December 2019. Forms Criteria on Incomplete ITRF. The 2022 filing programme stipulates that the Form E and CP8D ie Statement of Remuneration from Employment for the Year ending 31 December 2021 and Particulars of.

Form e-C and e-PT for YA 2021. YE 30 Sept 2019. Iii Procedure on the Submission of Form E and CP8D a The completed paper return E must be submitted to Bahagian Pengurusan Rekod Maklumat Percukaian Jabatan Operasi Cukai.

Download Forms - Company Category. Within 2 months of date of arrival. --Please Select-- Company Semua All Year.

Form to be received by IRB within 3 working days after the due. Income tax return for individual with business income income other than employment income Deadline. Aside from having to pay more if youre late to submit your tax form you will get fined if you understated your taxes dont submit a form at all or for various other offences.

Employers Form E Employers YA 2019 31 March 2020 31 May 2020 B. B Via postal delivery. Information on the submission date of RF Forms E BE B BT M MT P TP TJ TF 2020 and Forms CC1 PT TA TC TR TN 2021.

Use separate forms if the number of companies surrendering the loss exceeds five 5. The prescribed form for initial submission is Form CP204 and for revision of the initial submission is Form CP204A. Malaysia - Statutory Deadlines To Look Out For.

Individuals Partnerships Form BE Resident Individuals Who Do. September 08 2021. The Inland Revenue Board of Malaysia IRBM has published Operational Guideline No.

Form B is submitted by individuals with business income other than employment income for example sole proprietorship or partnership. Prepare Form CP8A CP8C EA EC for the year ended 2020 and render the completed form to all their employees on or before 28 February 2021. B extended from 15 july to 31 aug 2021.

Itr Awards 2022 Opens For Submissions International Tax Review

2022 Income Tax Return Filing Programme Issued Ey Malaysia

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Union Aid Poster Background Charity Poster Medical Illustration Poster

Seiko Solar Chronograph Divers Watch Ssc017p1 Ssc017

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Filing Your Taxes For The First Time In Malaysia Read This First Ya 2021 Althr Blog

Malaysia Personal Income Tax Guide 2022 Ya 2021

Lhdn Tax Filing Deadline Extended By 2 Months Rsm Malaysia

Coming Soon Seminar Internasional Kerjasama Stai Darunnajah Bogor Dengan Universitas Ibn Khaldun

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Michael C Ford This Isn T A Poem Cultural Daily

May 15 Deadline To Submit Tax Returns Via E Filing

Mcb Career Opportunities Jobs In Pakistan

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw